If you’ve ever gotten a call from a fake number or an email that looked legitimate but wasn’t — you’ve been spoofed. Spoofing is a trick scammers use to impersonate reputable businesses and government agencies to steal your data. These cybercriminals may even act as co-workers, friends, or family.

Fortunately, there are telltale signs to look out for to avoid becoming a victim. In this guide, we’ll break down the most common types of spoofing. You’ll learn how to spot fake calls and emails. Plus, you’ll get strategies curated by identity theft and cybersecurity experts on how to protect yourself. Let’s begin!

What is Spoofing?

Spoofing is when a scammer disguises themselves as someone you trust in order to steal your identity. For example, if you’re a Best Buy customer, you might receive fake emails about subscriptions you never signed up for or Geek Squad renewals.

>> Read More: Everything You Need to Know About the Geek Squad Scam

Hackers use fake phone numbers, email addresses, and websites to try and trick you. They make the content look real enough for you to engage with it. If you do, they can steal your personal information, money, or access to accounts.

What Are Common Types of Spoofing?

Scammers are constantly finding new ways to spoof people. While their methods vary, the goal is always the same. They want to gain your trust and exploit it. Here are some of the ways they do it:

- Caller ID spoofing: Scammers use a fake number that appears to be local or from a reputable business.

- SMS spoofing: They also send fake texts that seem to be from official sources but include malicious links.

- Website spoofing: Fraudulent websites mimic real ones but have slightly misspelled URLs and subtle differences to trick you into entering your login or payment details.

- IP spoofing: Hackers disguise their IP address to impersonate other devices to attack networks.

- GPS spoofing: Attackers use fake locations to manipulate apps and tracking tools for scams.

- Email spoofing: The sender’s name or email address looks like it’s from someone you know, a business, or a government agency.

>> Find Out: What Can Someone Do With Your Email Address?

Spoofing vs. Phishing

Spoofing and phishing are often confused. Our phishing guide goes into more detail about the basics and how to spot scam attempts. But here’s a brief overview of how spoofing and phishing compare.

| Focus | Spoofing | Phishing |

|---|---|---|

| Primary purpose | Imitate people, businesses, or government agencies | Trick you into revealing information or take unsafe actions |

| Tactics | Fake caller ID, forged email sender, and look-alike URLs | Emails, SMS messages, fake websites, and pop-up alerts |

| Relies on | Your trust in reliable sources | Fear, curiosity, or sense of urgency |

| Interaction required | Not necessarily; seeing the number or email may be enough | Usually requires clicking, downloading, or replying |

| Relationship | Can be used alone or to make phishing attack look more credible | Often built on spoofed content to seem legitimate |

What Scammers Want

While spoofing is annoying, what scammers really want is your data. Some of the information they’ll attempt to steal includes:

- Identifiable information: This can include your full name, birthday, Social Security number, and any other personally identifiable information.

- Financial details: Scammers will mimic payment platforms to steal your bank account or credit card information.

- Account credentials: It could be your email login or username and password for social media accounts. These details can be repurposed or sold on the dark web.

- Location: GPS spoofing and scam apps can monitor your movements and target you based on where you are.

- Device information: Some spoofing attempts trick you into downloading malware, giving scammers access to your phone or computer.

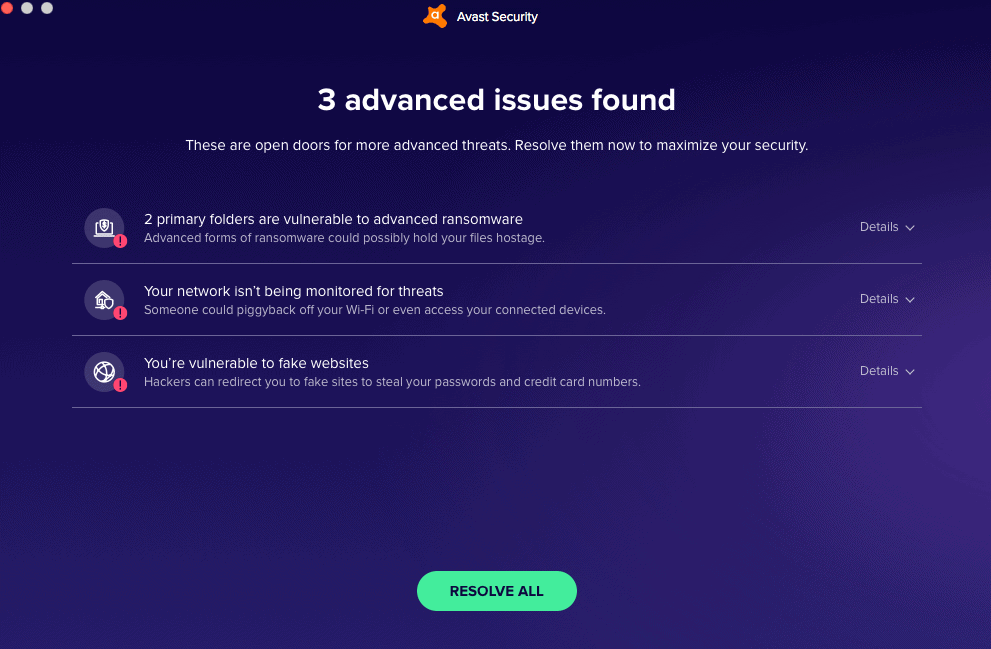

Pro Tip: You might be wondering if you still need antivirus protection in 2025. The answer is yes. We have tested some of the best antivirus apps to remove malware, spyware, and ransomware from a range of devices.

What Are the Impacts of Spoofing?

On Individuals

When spoofing is successful, it can lead to serious consequences like financial loss and identity theft. Scammers may open new accounts or take out loans in your name, causing long-term damage to your reputation and credit. You might not realize it until strange charges appear in your transaction history or you’re denied a loan or line of credit.

FYI: The best identity theft protection services monitor your bank accounts and credit cards for unauthorized transactions. They also look for accounts opened in your name, including payday loans, which are for smaller amounts and have significant fees and charges.

On Businesses

Spoofing also impacts businesses. If a scammer impersonates a company, it could lead to data breaches, compromised systems, and unauthorized payments. That’s why it’s so important to know how to recognize spoofing attempts early before the damage is done.

How to Spot a Spoofing Attempt

Scammers are producing more convincing spoofing materials, but they’re still not perfect. Many scams include subtle clues that something is off. You just have to know what to look for. Here are some of the ways to tell if you’re dealing with a spam call, fake email, or malicious text:

- Spelling and grammar mistakes: Many spoofed messages are misspelled or poorly written. You might notice odd formatting or non-U.S. spelling.

- Generic greeting: Phrases like “Dear Customer” or “Hello User” instead of your name are instant red flags.

- Unexpected message: If you’ve never received a text from the company before, be suspicious.

- Look-alike email address or URL: Always double-check the spelling of email addresses and websites. We’ve seen messages from “Apple” with three p’s and “Amazon” spelled as “Amazan”.

- Pressure to act fast: Many fake messages create urgency by putting a time limit on the request. They may claim your account will lock within 24 hours if you don’t click a link.

- Requests for your account information: Legitimate businesses won’t ask for your passwords, Social Security Number, or credit card number via text or email.

- Unusual attachments: If you spot PDFs, zip files, or Word docs within the email, don’t open them. We recommend scanning them with antivirus software to make sure any attachments aren’t malware.

- Inconsistent branding: Some fake messages feature blurry logos, weird color schemes, and odd fonts.

- Strange requests: If a co-worker, friend, or family member suddenly asks for money or gift cards out of the blue, call them to verify it’s really them.

>> Expert Advice: How to Avoid Gift Card Scams

How to Protect Yourself

You don’t need to be a cybersecurity expert to stay safe from spoofing. A few smart habits can make a big difference. By following these tips, you’ll be harder to trick and better equipped to keep your personal information secure.

- Confirm unsolicited content: If you get a message that seems out of the blue, verify it with the person or the company directly via its customer service teams.

- Never click links: Avoid clicking links in emails or messages. We recommend going to the company’s website instead.

- Update your devices regularly: Install updates for apps or systems once they are available. They patch vulnerabilities and include the latest security protection.

- Block and report suspicious calls and messages: Apple and Android phones let you block spam calls and messages. If you get a robocall or fake message, report it to avoid being spoofed.

- Never send personal details via email or text: Message apps are not secure channels, so never send sensitive details like Social Security numbers, credit card numbers, or passwords via text.

- Enable MFA where you can: Multi-factor authentication adds an extra security layer and alerts you when someone tries to access your accounts.

- Communicate with your contacts: Keep friends and family members in the loop if your data is leaked or you notice an increase in spoofing attempts. They might be targeted next.

- Use strong, unique passwords: Protect your accounts with passwords that have at least 16 characters and feature a mix of upper and lowercase letters, numbers, and symbols. Never reuse the same ones for different accounts, like the 68 percent of respondents to our survey on password habits.

Pro Tip: Trying to come up with dozens of different passwords with various characters is tough, which is why we created a password generator to do it for you. We recommend storing them in a password manager for easy access and extra security.

Tools to Protect Yourself From Spoofing

You don’t have to rely on your own habits to defend yourself from spoofing. There are also various digital security tools that safeguard your information, protect you from scams, and give you control of your digital identity. These are just some of the tools we recommend using.

Password Manager

We use password managers to store all our login credentials inside their military-grade vaults. When we log into a website, the app auto-fills the fields so we can log in securely. Some of the best password managers even monitor the dark web to check if your data is for sale.

Password managers protect you from spoofing if you accidentally click on a fake URL. If your credentials don’t autofill in the login fields, it’s a warning sign that the site is fake.

Pro Tip: Password managers tell you how strong your passwords are. But if you want a second opinion, check out our password strength checker to see how easy it is to guess.

Antivirus Software

We’ve already mentioned how important antivirus software is to protecting you against spoofing — but it’s worth repeating. These apps block infected links and attachments before they can harm your device or steal your identity.

Antivirus software offers real-time protection, so you won’t need to initiate a scan to check a file or website. You’ll get warnings about downloads and websites before you visit them. Just make sure to keep it updated as new threats emerge daily.

Identity Theft Protection

You should use identity theft protection services to monitor your personal and financial information. You’ll get alerts if bank accounts or email addresses are misused or sold. Many include credit monitoring and recovery support if your identity is stolen.

>> Find Out: The Best Identity Theft Protection With Credit Reporting

This is useful if you fall victim to a spoofing scam. If you notice unusual transactions or an increase in spam, you can freeze your credit immediately and stop fraudulent activities before they gets out of control.

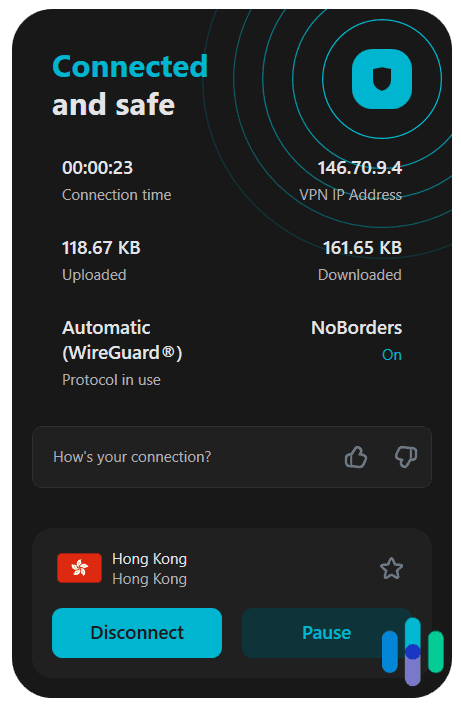

VPN

Virtual private networks encrypt your internet traffic and hide your IP address, making it hard for hackers to target you with spoofing attempts. It’s particularly useful for unsecure connections like public Wi-Fi.

VPNs won’t block spoofed emails or text directly. They add an extra layer of privacy, making it harder for attackers to track your location and reducing their scams’ effectiveness.

FYI: One of our favorite VPNs, Surfshark, includes additional security tools to protect your data. You can create fake email addresses and aliases to avoid using your real information when signing up for accounts.

Data Removal Service

You’d be shocked to know how much information data brokers have on you. Thankfully, data removal services can request deletion of these details on your behalf. This makes it harder for scammers to create spoofing campaigns tailored to you.

Beware that once your data is removed from a broker’s database, it can be added again. However, data removal services are prepared and offer ongoing monitoring to delete it again.

>> Learn More: How to Remove Your Information From the Internet

What to Do If You’ve Been Spoofed

Spoofing can happen to anyone. If you do fall victim to a scam, here are some steps you can take to minimize the damage:

- Block all communication: Block the number or email address sending messages so you can’t click links or download attachments.

- Change your passwords: Update your financial, social media, and email passwords first. Then move on to other accounts just in case.

- Review your accounts: Monitor bank statements, emails, and credit reports for unusual activity. Check if anyone has opened accounts in your name.

- Contact the business or person being spoofed: Let the business or individual know what has happened so they can warn others and secure their accounts.

- Report the scam: Contact your local authorities and report the fraud to the Federal Trade Commission.

Final Thoughts

Spoofing isn’t unstoppable, especially when you know what to look for. Scammers rely on urgency to trick you into acting fast. But when you pause, evaluate, and recognize fake messages and websites — you win.

Practicing safe digital habits and using security tools add extra layers of protection. Even as spoofing tactics evolve, these defenses will keep your information secure no matter what scammers try.

FAQs

-

Can someone steal your identity by spoofing your phone number?

Spoofing a phone number doesn’t give scammers access to the data. It’s often used as part of a bigger scheme. Scammers know you’re more likely to answer a call or share information with someone you know, which is why they spoof friends, family members, or companies you interact with.

-

What’s the difference between spoofing and spam?

Spoofing is when scammers disguise their identity. Spam refers to unwanted or unsolicited messages, which may or may not include spoofing. For example, some spam is just marketing communications.

-

Can antivirus software detect spoofing attempts?

Antivirus software won’t always detect spoofed messages or calls, but it will block malicious links and attachments from those attempts.

-

Should you answer unknown numbers to see if they’re fake?

We recommend not answering unknown calls as it can confirm your phone number is active, resulting in more scam attempts. Instead, use call-blocking features to filter suspicious calls and texts.

-

Do spoofed texts infect your phone when opened?

Open a spoofed text won’t infect your phone. However, if you click on a link or download an attachment, it might install malware or take you to a phishing site. If the message doesn’t look right, delete it and block the number.